Success case ■ |

Assetsman has completed more than 1,500 industrial asset management projects for its clients. Discover some very interesting results obtained by our customers through the studies presented below.

For each completed project (Success Case), we tell you:

- The client's industry

- The context of this client's project

- The problem identified and the methodology used to meet the client's needs

- And above all the tangible results that we were able to obtain for the client

We are listening to you to better detail these studies and their results, hoping to be able to bring you our experiences and skills to help you find sources of effective and concrete gain.

|

Client's Needs

Specialised in Urban Transport, the company operates and keeps the means of transport but also, among others, the subterranean stations that receive the public. The system of compressors, among the multiple assets required for the effective operation of these stations, was the object of systematic replacements.

The Multiannual Plan of Replacement – PPR, includes the demands of financing for the whole industrial asset site. In view of the financial constraints that do not allow to assure the replacements according to the dispositions of the PPR, it would be necessary to find some alternative scenarios of replacement:

Vertical Divider

|

ASSETSMAN's solution

ASSETSMAN used its tool ASSETSVALUE (decision support tool for industrial asset management) to identify the alternative scenarios and the best solution.

The module Life Cycle Cost Renewal allowed to determine the best technical-economical solution of replacement and to define the appropriate moment. The definition of the equipment families (to the similar profiles) allowed to take into account the differences between the profiles of operation, environment, and age of the assets in the site to produce the conclusive results. This methodology allowed us, from a limited number of simulations, to get the closest result to the reality. The studies based on the optimisation Risk / Cost provided, with accuracy, the elements of calculus required to establish a PPR to the horizon of 10 years respecting the budget constraints. |

|

Demonstration of a possible EXTENSION OF LIFESPAN OF

%

without exposition to risk |

%

of investment budget reduced OVER 10 YEARS |

Complete replacement vs partial replacement equals to

%

of reduction of the investment budget OVER 10 YEARS |

|

Client's Needs

The company, which is specialized in clean up and depollution of waste water, has several treatment plants. The recovery of the rejected material that is issued from the treatment of this waste water is a complex process that requires several stages, including the passage of a phase of combustion and drying, in a specific unit, before transformation and valorisation.

Out of one of the required equipmentsfor the operation of this drying unit, the company defined a strategy to keep in stock a certain number of spare parts. The company wanted to verify the relevance of this sizing of stock and measure the exposition of risks to which it would be exposed when reducing this sizing. Questions : Is it possible to reduce this level of stock? To which optimum? Which risks could: •result in increase the stock to +1? •justify keeping the current stock? Vertical Divider

|

ASSETSMAN's solution

ASSETSMAN used two modules of its tool ASSETSVALUE (decision support tool for industrial asset management).

The modules STOCK STRATÉGIQUE and STOCK CONSOMMABLE of ASSETSVALUE allows to measure the strategic decisions regarding the stock policy, taking into account the features of the considered equipment, consumption, functioning of the logistic chain of supply, among others, and other factors of the modeling Risk / Cost. By carrying out the optimisation studies Risk / Cost, ASSETSMAN could provide with accuracy the elements of calculation to answer to the following problems: The OPTIMUM SIZING OF STOCK, namely the number of references to keep in stock to this equipment, and the evaluation of GAINS IN OPPORTUNITIES RISK/COST by adopting this strategy. The DEMONSTRATION OF FLEXIBILITY of this sizing, namely: •the identification of scenario that would lead to declare this optimum result, that is to ADD A SUPPLEMENTARY EQUIPMENT. •the identification of scenario that would justify to keep the CURRENT STRATEGY OF SIZING. |

|

The OPTIMUM SIZING is to to keep only

%

of the initial number of equipments in STOCK (2 instead of 4) |

The GAIN IN OPPORTUNITIES to choose this strategy is equal to

%

PER YEAR of the value of the new equipment* * of a value between 15K and 20K per equipment |

SENSITIVITY OF RESULTS

It would require one situation with a period of unavailability of 2,5 times longer to justify the stock of 1 additional equipment It would require one exceptional situation with a delay of supply 4,5 times higher, to justify to keep the strategy of the current stock (stock 4 equipments) |

|

Client's Needs

The company specializing in the production of hydroelectric renewable energy has a fleet of around twenty alternators for which the question of renewal arises.

A renewal plan was therefore considered, taking into account the lifespan estimated by the manufacturer, to maintain the expected production performance of these alternators. A budgetary and organizational constraint specific to the company only allows for one alternator replacement every two years. The company wishes to estimate the exposure to the risks to which it was exposed given these constraints Vertical Divider

|

ASSETSMAN's solution

ASSETSMAN proposed solutions using its ASSETSVALUE tool (decision-making tool in the management of asset management). By carrying out Risk / Cost optimization studies, ASSETSMAN was able to provide precise calculations for:

• THE ACTUAL LIFE of the alternators based on the modeling of their reliability. • Determining the opportune moment of identical replacement of the alternators and estimating the LACK OF WIN if we shift from this optimum • THE GRAY DEBT* to which the company is exposed with its current organizational constraints. * gray debt: cumulative shortfall generated by renewal deferrals. |

|

The ACTUAL LIFE is

%

longer than the lifespan estimated by the manufacturer |

LOSS OF PROFIT, considering the current renewal plan, is equal to

%

of the replacement value of each alternator* *the value corresponds toa few million euros |

The FINANCIAL DEFICIT is equivalent to

%

of the replacement value of a new alternators group*, considering the current renovatio plann * the current power plant of 20 alternators |

|

Client's Needs

The interval of preventive maintenance of equipments is a problem for the client.

He follows the orientations of the manufacturer, replacing the equipment every 10 years When noticing a level of the tool failure of 5% before 7 years, he wants to reconsider the intervals of preventive maintenance. The restrictive conditions for the tooling maintenance are the following: • Refurbishing cost : 470K€ • Intervention time : 10 days Vertical Divider

|

ASSETSMAN's solution

ASSETSMAN's team used ASSETSVALUE to:

• Value the cost of the current preventive maintenance task • Define the interval of maintenance for the lower cost • Value the gain between Assetsman's results and the current policy of the client |

|

New calculated preventive maintenance interval:

Refurbish the equipment every

years

|

Economy of

K$ / year

Compared to the current situation

years

|

Saving of

K$ / year

Compared to a more conservative preventive maintenance interval:

|

|

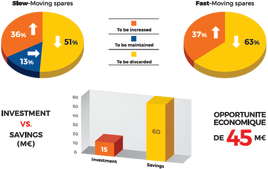

Client's needs

Policy of spare parts stock considered very conservative by the client.

He wants to implement an evaluation and optimization of the stock policy to obtain economy. The study involves 45.000 spare parts, 3 power generating plants and 10 independet substations. The stock policy currently is cautious, since the client has to assure the continuous supply of electricity and water. The client's objective is to define which spare parts should be reduced, maintained, or increased. Vertical Divider

|

ASSETSMAN's solution

ASSETSMAN's team used ASSETSVALUE to:

• Value the client's current stock in terms of cost and risk • De fine a level of consented risk for the client • Resize the stock based on this consented • Define a new policy for spare parts stock • Value the gain between ASSETSMAN's results and the current policy of the client |

|

Client's needs

The client wants to reduce the cost of their major annual maintenance shutdowns at the lowest risk.

Two cases to deal with regrouping 70 equipments of 4 different families. The cost of the current major shutdowns is between 1 and 4 million euros (3 shutdowns / year). Vertical Divider

|

ASSETSMAN's solution

ASSETSMAN's team used ASSETSVALUE to:

• Accurately value the annual cost of major client shutdowns • Determine for each task the appropriate time to perform it • Converge all tasks to a common Optimum on the best risk/cost trade-off • Evaluate the gain between the ASSETSMAN result and the client's current policy |

|

Simulation of

Different preventive maintenance tasks

|

Planning

shutdown less in

stops per year or 1 stop less per year

|

Economy of

% over the annual costs of the major shutdowns

|

|

Client's needs

The equipment availability is considered inadequate by the client.

He wants to implement an approach to improve the availability of production equipments and, particularly to: • Reduce failure rates • Reduce recurrent malfunctions • Reduce the periods of unavailability due to preventive maintenance Vertical Divider

|

ASSETSMAN's solution

ASSETSMAN's team used ASSETSVALUE to:

• Implement the method CBA (Core Business Analysis): identification of the equipments that obstruct reaching the availability objectives (bottlenecks) • Carry out trainings of the methods RCM and RCA (over 100 people trained) • Carry out pilot studies for relevant workshops • Follow the teams as part of the development of the approach RC< and RCA in the plant |

|

Reduction of

% in the operations of maintenance control and review of TPM standards

|

Gains of

hours of workforce/year |

Reduction of unavailability of equipments for preventive maintenance of around

hours

|

|

Client's needs

Concern with the image of brand and marketing communication with the interested parts and aviation professionals.

The client wants to show the efficient asset management to the regulatory authorities. To do that he needs to create a system of asset management according to ISO 55001. Stating the approach in the second semester of 2014. Vertical Divider

|

ASSETSMAN's solution

ASSETSMAN's team used its expertise on the standard ISO 55001 to:

• Carry out a diagnosis using the maturity scales provided by the IAMS method (interactive assessment for asset & maintenance strategies) • Develop and implement a master plan of Asset Management • Set up an asset management system • Train and monitor teams (one hundred professionals trained) • Carry out pilot studies (RCM/LCC…) that legitimize the appropriate beginning of the master plan and enable to get the first gains |

|

Certification ISO 55001 obtained by the client in less than

years

|

Support to the teams

trained people

|

First savings

achieved thanks to pilot studies |

|

Client's needs

The client has 40 investments projects to carry out, half of them are considered urgent and with a high added-value.

Incapable of carrying them out immediately (annual budget restricted), the client needs an alternative investment plan in the next 5 years. He wants to prioritize the investment projects (CAPEX) taking into account the trade-off between risks and costs. Vertical Divider

|

ASSETSMAN's solution

ASSETSMAN's team used ASSETSVALUE to:

• Define the appropriate moment to carry out the investment projects (LCC) • Determine the losses due to the anticipation or delay in the conclusion of the projects • Elaborate different scenarios of investment to find the most appropriate one regarding to the client's needs (budget limits) • Help the client choose the scenario according to the trade-off risk / cost |

|

+ than

alternative scenarios proposed |

Economy of

K€

increasing the limite of investment in

%

|

Investment Plan

optimized according to the restrictions of annual investments |

Assetsman2, passage Roche

78000 Versailles |

Projets réalisés

|

Articles récents

Témoignages

Mentions légales

Copyright © Assetsman 2023 |

|

ASSETSMAN

(55) 11 5549-9938

[email protected] Rua Tenente Gomes Ribeiro, 57 - cj. 16

04038-040 – São Paulo – São Paulo |

PROJETOS REALIZADOS

|

ARTIGOS

DEPOIMENTOS

Aviso legal

Copyright © Assetsman 2023 |

|

ASSETSMAN

+33 (0)1 39 50 79 48

[email protected] 2, passage Roche

78000 Versailles |

PROJECTS

|

ARTICLES

TESTIMONIALS

Legal notice

Copyright © Assetsman 2023 |